tax refund calculator ontario 2022

Answer A Few Questions To Get A Free Estimate Of. Itemized deductions are a list of.

Alberta Disability Tax Credit Information

Between April 1 2020 and October 1 2020 and again between January 1 2022 and July 1 2022.

. As per the Income Tax Act a person is required to file hisher return in the relevant assessment year by July 31 unless the deadline is extended to claim the tax refund. Standard deductions lower your income by one fixed amount. Tax rates and how to calculate EHT Rates.

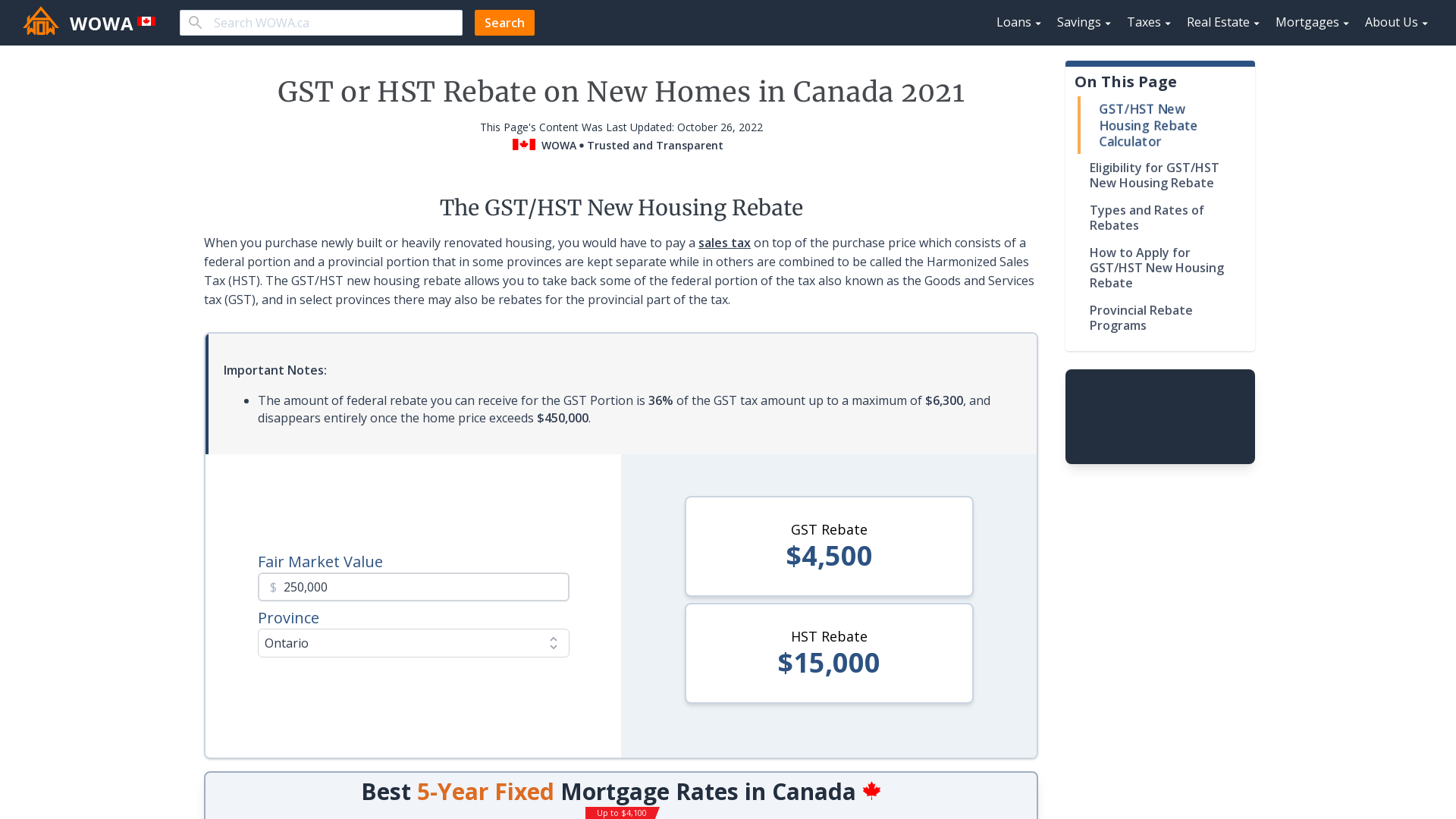

For 2022 the non-refundable basic personal amount in Ontario is 11141 along with an extra tax reduction amount that Ontario provides to its residents. There is also a surtax that. Use our free 2022 Ontario income tax calculator to see how much you will pay in taxes.

You can also explore Canadian federal tax brackets provincial tax brackets and Canadas federal and provincial tax rates. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. 2022 Personal tax calculator.

Calculate the total income taxes of the Ontario residents for 2022. This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and. Get better visibility to your tax bracket marginal tax rate average tax.

The Ontario land transfer tax for a home purchased for 500000 in Ottawa is 6475. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. Income Tax Return Calculator Ontario 2022.

Tax Refund Calculator Ontario 2022. Our tax refund calculator will show you how. The ontario staycation tax credit.

2022 Tax Calculator Estimator - W-4-Pro. TurboTax Free customers are entitled to a payment of 999. The 2022 tax year runs from 1 st january 2022 through to the 31 st december 2022 in ontario with tax returns due for specific.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Newfoundland and Labrador NL. 2022 Income Tax Calculator Canada 2022 free Canada income tax calculator to quickly estimate your provincial taxes.

These are your total credits. If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. This calculator is for 2022 Tax Returns.

Calculate your combined federal and provincial tax bill in each province and territory. The maximum tax refund is 4000 as the property is over 368000. That means that your net pay will be 37957 per year or 3163 per month.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Tax refund calculator ontario 2022. This calculator is intended to be used for planning purposes.

DATEucator - Your 2022 Tax Refund Date. If you make 52000 a year living. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Calculate your refund fast and easy with our tax refund estimator. 2022 Income Tax Calculator Ontario. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

W-4 Pro - Tax Return Based W-4 Form. Carrying charges and interest expenses attach Schedule 4 Deduction for CPP or QPP contributions on self-employment and other earnings attach Schedule 8 or Form RC381. The calculator reflects known rates as of June 1 2022.

Capital Gains Tax What Is It When Do You Pay It

How Are Tax Refunds Affected In A Bankruptcy Bankruptcy Canada

Cra Announces Prescribed Rate For Q2 2022 Advisor S Edge

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

How Do Quarterly Income Tax Installments Work Moneysense

T657 Tax Form Calculation Of Capital Gains Deduction 2022 Turbotax Canada Tips

Gross Up Add Backs Explained How To Increase Income For A Mortgage

Toronto Land Transfer Tax Calculator Rates Rebates

2022 Canada Tax Filing Deadline What You Need To Know Compass Accounting

Tax Credit Calculator Sunnybrook Foundation

There S A Tricky Virtual Currency Question On Your Tax Return

How To Get A Full Tax Refund As An International Student In Us

Tax Year 2023 January December 2023 Plan Your Taxes

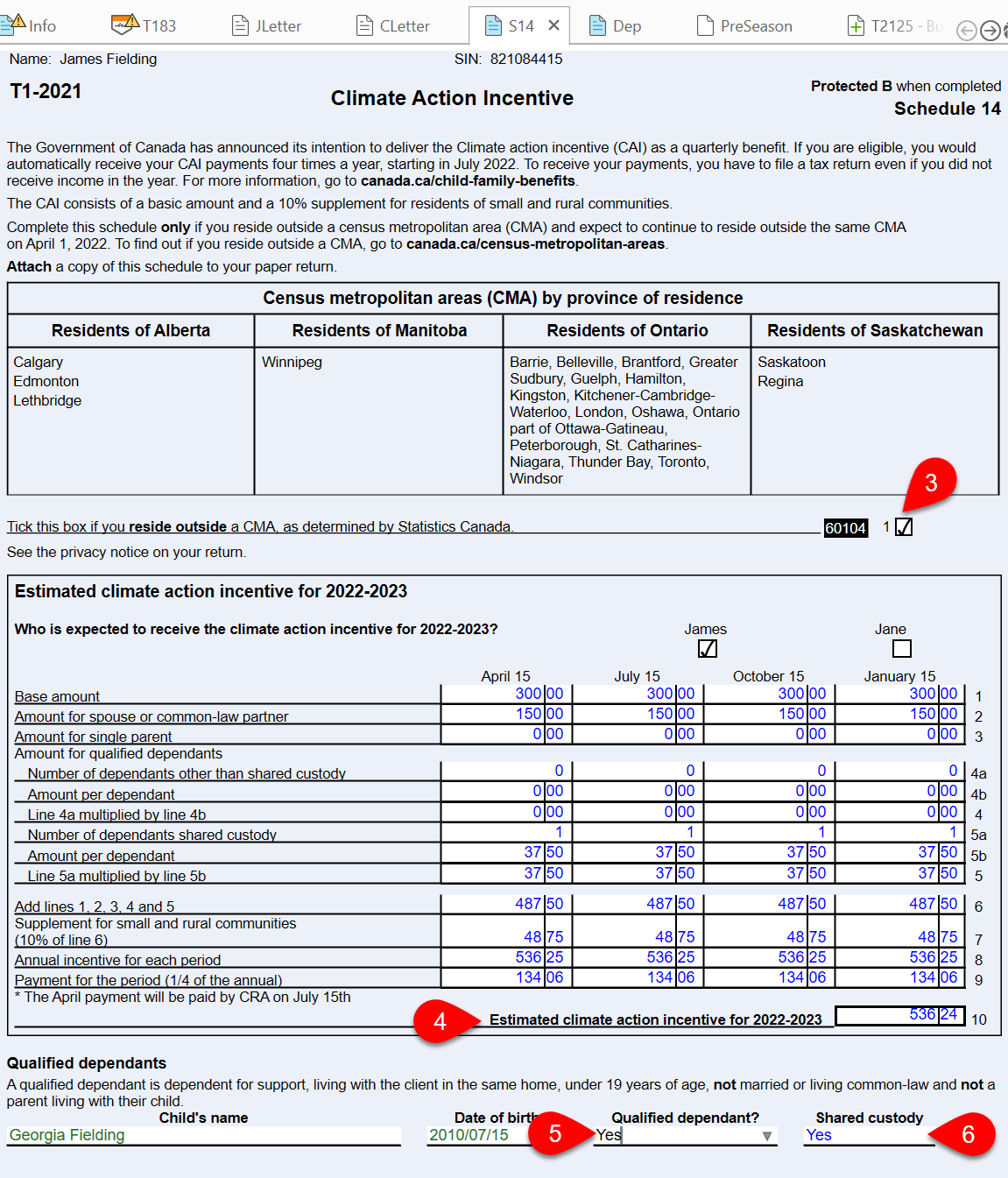

Quarterly Payments For The Climate Action Incentive Revised Taxcycle